A new report, published by Whitecap Consulting in partnership with Tech South West, forecasts the South West of England’s tech sector is set to grow to almost £20bn gross value added (GVA) a year by 2026, creating over 125,000 new jobs.

The research, commissioned by Tech South West, reveals that the South West is rapidly becoming a global leader in environmental tech, with internationally recognised tech firms, centres of excellence, science parks, university research, and innovation hubs in specialisms including Environmental Science, MarineTech, Climate Science and CleanTech, along with FinTech, Deep Tech and Robotics.

The South West has the fifth largest tech sector of the 12 major regions in the UK, worth £11bn GVA annually, and is now generating around one in 11 (7.9%) of all new tech startups in the country. With nearly 170,000 people working in the sector, the GVA per capita of £1,943 is the second highest in the UK when compared to all other regions outside London and the South East, the study reveals.

The research found that if growth rates continue in line with the past five years, even factoring in the economic disruption caused by the pandemic, the South West’s tech sector will be worth £19.2bn by 2026. Tech job creation in the region is forecast at 75%, rising from 168,169 in 2021 to 294,380 by 2026, an additional 126,212.

The South West also now accounts for the largest proportion of the UK’s tech lending outside London and the South East, with Bristol the primary hub for investment secured. Tech South West has launched a Funding Advisory Board to help develop the funding ecosystem and opportunities across the region.

Richard Coates, managing director of Whitecap Consulting, said:

“Whitecap is delighted to have had the opportunity to work with Tech South West and the sponsors of this work to conduct an analysis of the impressive and fast growing tech sector in the South West. Our report provides a data-driven overview of the region and key sub-regions, and identifies key themes and associated recommendations that, if acted upon, can provide the basis for significant future growth and job creation.”

Dan Pritchard, co-founder of Tech South West, said:

“The South West of England’s tech sector is on an upward curve. Not only is this fantastic for the economy and jobs, it’s evidence of the role the region plays globally in tackling climate change. With international tech specialisms including climate and environmental science, marine tech, cleantech and agritech, the South West is fast becoming the UK’s natural green powerhouse of tech. It is substantial growth and a huge number of vacancies, which will require a combination of improved productivity and efficiencies, talent, and automation to help us get there.”

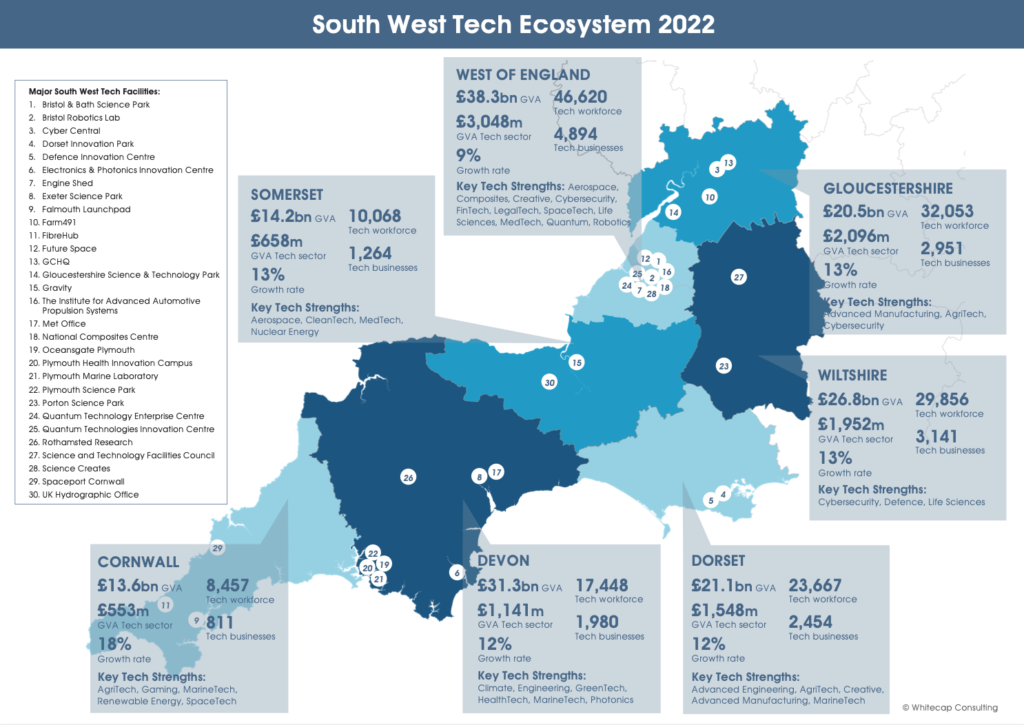

The report includes findings on startups, scaleups, research, innovation, investment and funding, and talent across what is the largest of the English regions, covering Cornwall, Devon, Dorset, Gloucestershire, Somerset, West of England, and Wiltshire.

Dave Tansley, UK vice chair at Deloitte, said:

“Innovation is an essential element of business strategy, with technology a key enabler. The exponential growth expected is therefore good news for businesses across the region. It’s a very exciting time to be involved in this sector, but along with the financial benefits of growth to the region come some challenges as the report points out. How do we create, attract and retain talent? Collaboration – getting the region working together, not in competition, and funding – how does the South West get its share? This report is just the start of a region-wide collaboration to make this tech sector growth opportunity a reality.”

Key facilities and research centres flourish including universities and science parks in Bristol, Exeter, Falmouth and Plymouth, the National Composites Centre, Quantum Technologies Enterprise and Innovation Centres, Met Office, Spaceport Cornwall and Plymouth Marine Laboratory.

There are challenges, particularly around talent. The region has 14 universities and nearly 170,000 students, including 19,500 tech and engineering students (11% of all students, compared to 7% UK average), but has a high vacancy rate across the tech sector, with recruitment difficulties and salary inflation. Whilst still low, the report does reveal that the sector has double the proportion of black and minority ethnic employees (8.8%) compared to the region’s overall ethnic minority population.

Chris Evans, director of Innovation, Impact and Business at the University of Exeter, said:

“This research is perfectly timed and emphasises that as a region we have an opportunity to achieve something really significant. We must work together to target resources such as Levelling Up and the Shared Prosperity Fund to make sure our innovative R&D can help drive the sectors with a real competitive advantage.”

Toby Parkins, chair of Tech South West and co-founder of Cornwall-based software firm Headforwards, said:

“The tech sector is creating growth at rates exceeding all other sectors. This report clearly demonstrates that the whole tech sector needs to be embraced to create significant economic growth.”

In addition to working in partnership with Tech South West, this project has been supported by Deloitte, Astley Media, Censornet, CoreBlue, NatWest and the University of Exeter.

The report can be downloaded in a high resolution or email-friendly low resolution here.