Understanding the UK market

The UK is home to the 3rd largest population in Europe, who have become increasingly digitally competent and supported the development of an increasingly digital economy. The labour market is attractive, meaning the volume of job vacancies is typically high and unemployment is relatively low, which is supported by good growth in jobs, particularly in high value / skilled occupations. The UK has a vibrant tech ecosystem underpinned by innovation hubs, world-class universities and a highly-skilled, diverse workforce. As a consequence, the UK is home to a wide range of fast growth tech sectors including, but not limited to: Advanced Manufacturing, BioTech, AgriTech, CleanTech, DeepTech, EdTech, Enterprise Technology, FinTech, Gaming, HealthTech, LegalTech and RetailTech.

Whilst the breadth of fast-growing and innovative tech sectors are owed in no small part to the availability of talent, digitally literate customers and forward-thinking founders; the availability of funding and the ongoing commitment to innovation by the Government are worth noting. The UK Government’s focus and funding, for example through the UK Innovation Strategy and initiatives such as the Tech Nation Visa Scheme, have helped create an attractive proposition for businesses seeking to operate here.

The scale and scope of these drivers of growth have generated widespread interest in entering UK markets, from domestic and international individuals / organisations alike. However, in many tech markets fast-changing customer preferences, increasingly competitive landscapes and a mounting regulatory burden make strategic planning paramount for any tech business – even before baking in the added challenge of entering a foreign market.

Challenges to foreign entry

Many of the challenges of entering a foreign market are relevant also to expanding domestically, which includes developing a deep understanding of customer needs, creating an attractive and competitive proposition, developing a go-to-market strategy, and flexing to various regulatory considerations. In fast-growing UK tech markets, the quality of these activities must be superb to succeed – particularly in the more established and / or tightly regulated tech markets.

For example, Financial Services is a highly established and sophisticated market and is a target of one of the UK’s most advanced tech sectors – financial technology or ‘FinTech’. FinTech organisations (domestic and foreign) have spent a significant amount of time and resource seeking ways to serve the needs of UK consumers and financial services organisations; so much so that identifying commercially viable ‘white space’ is commonly regarded as difficult. Furthermore, regulatory pressure has developed a more risk averse customer set with regards to technology – certainly business critical technology.

Critically, the need to deeply understand your target market and develop a trusted business model is paramount for successful entry into this market whether you are a domestic or foreign organisation. What makes foreign markets more difficult is that, rather than introducing a wide variety of new challenges, it typically makes the existing set of challenges harder to solve – at least from a commercial perspective. This added difficulty stems primarily from hitting the ‘reset button’ on much of what you already know about the way your market operates; and navigating differences in business culture. In the next few sections, I walk through a few exercises that can help support market entry and tackle the heightened difficulty level of foreign market entry.

Market analysis: understanding the broader market context

In most forms of strategic decision-making, developing a strong understanding of the market context is a common and useful first step. This exercise typically includes a review of market size, market growth projections (including identifying the most significant drivers of growth), customer behaviour and competitor strategy(s).

What is particularly important to note here is that a market’s characteristics and dynamics can change drastically from country to country. HealthTech is an excellent example. The UK is rather unique in that the primary buyer group for HealthTech products and services is the National Health Service ( NHS) – which makes this market rather alien, as most of the buy-side is heavily concentrated within a single publicly funded organisation. This generates a range of additional hurdles for aspiring market entrants including a web of bureaucratic processes and tight purchasing controls. However, in practice and rather counterintuitively, the NHS is highly variable in its approach, openness and funding for HealthTech products and services, which varies even further depending on the product and service being assessed.

Another good example is in financial services, more specifically the degree of intermediation in the UK mortgage market. The UK has the largest mortgage lending market in Europe, and most new mortgages are facilitated by intermediaries. The significance of this market dynamic means that customers often demand that aspiring FinTechs already have a seamless process for fitting into an intermediary relationship (assuming the product or service is relevant) and is already (or with very little effort, be) calibrated to a financial services organisation’s process flow if they wish to appear competitive to existing offerings.

Proposition validation: showcasing the importance of stakeholder consultation

It is not uncommon for prospective foreign market entrants to assume that what works in other markets works in the UK – this is not always the case. The two examples I highlighted earlier in HealthTech and FinTech help tell this story, as organisations in the UK may not have the same problems as those overseas, or describe them in the same way, or prioritise them in the same order.

So, validating that your organisation’s proposition(s) is strongly aligned with the UK market is paramount – particularly for fast growing and highly competitive tech sectors. Typically, we find that one of the best ways to achieve this is through consulting key UK stakeholders, to test key customer needs, drivers of purchase and selection criteria, experience with existing providers, typical routes to market, product and service delivery considerations, and regulatory considerations.

Strategic partnerships: bridging the gap

Strategic partnerships are not a novel concept and have been gaining in popularity over time. Partnerships can take various forms, from simple branding, to strategic sales and marketing strategies, and delivery partners for key operations of the business. Seeking synergetic and forward-looking relationships with organisations in and around your market is as important for many domestic organisations as it is for prospective foreign entrants. The value these relationships can deliver can be framed in a similar way for domestic and foreign organisations, though for foreign organisations in particular, it helps bridge gaps in their connection to and fit within the domestic markets – which is often critical to help ensure a smoother market entry than ‘going it alone’.

Some of these gaps are simple commercial levers like routes to market, bolt-on product and service offerings, service delivery, and innovation pathways (typically for R&D purposes). However, some of these are softer yet still critically important such as understanding the domestic market(s) and business culture.

Summary

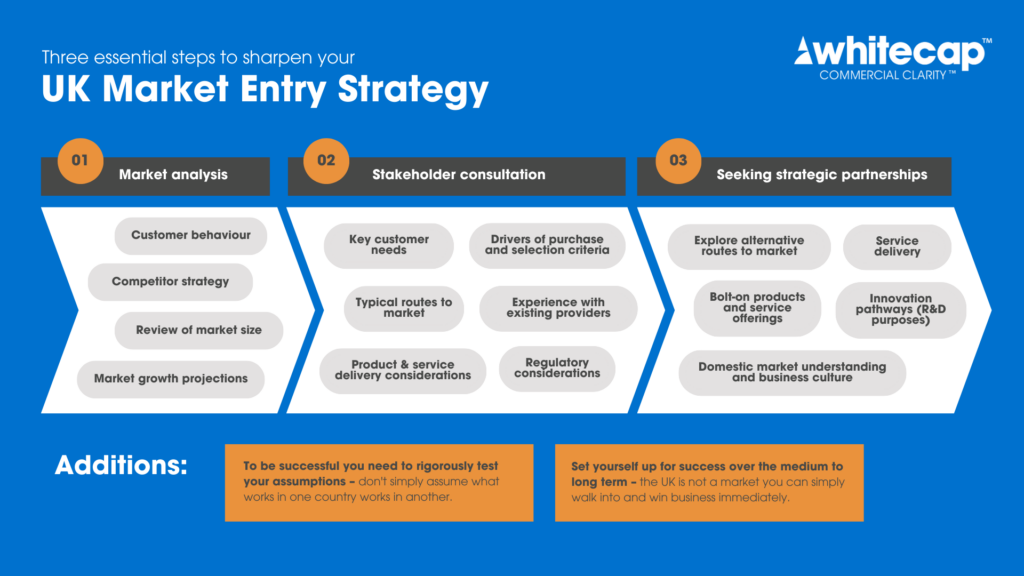

Whilst many UK tech markets are often considered highly attractive by foreign organisations, they are also challenging to enter successfully. To set your organisation up for success, I recommend three steps that we often deploy to help our clients sharpen their UK market entry strategy:

- market analysis,

- stakeholder consultation,

- and seeking strategic partnerships.

If exploring the UK is a frequent discussion point for your organisation, or you have some specific questions about a UK tech market you would like to discuss, the team at Whitecap Consulting are here to help.