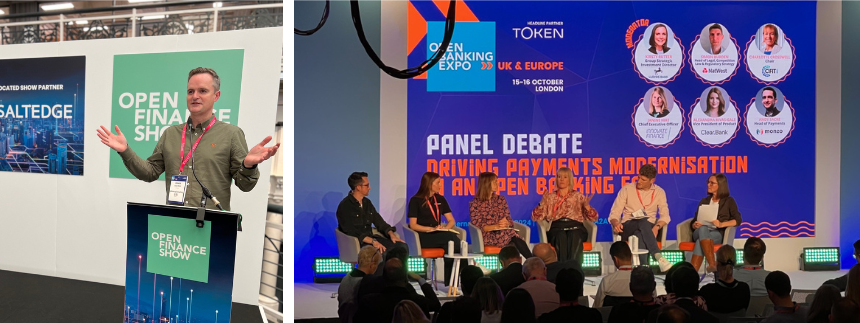

Whitecap has been involved in Open Banking Expo since its inception back in 2018 and it’s always a favourite date in my diary. This year I also had the honour of chairing the Open Finance Show, which takes place within the overall conference and exhibition.

As the Open Finance stream didn’t start until late morning, I was able to attend the opening sessions on the main stage, which are always a great temperature check on how the sector is feeling about Open Banking, and the much discussed evolution into Open Finance and Open Data.

A sense of frustration

This year, the distinct impression I took away was that whilst the industry continues to make progress with Open Banking adoption and some of its key use cases such as account to account payments, this progress was countered by a sense of frustration about the pace of adoption, and the impact this is having on the UK’s global competitive position.

This feeling was no doubt heightened by announcement from the USA shortly after the Expo, confirming that the Consumer Financial Protection Bureau (CFPB) has finalised the Personal Financial Data Rights rule, which it said “moves” the US closer to “a competitive, safe, secure, and reliable” Open Banking ecosystem.

To illustrate the underlying feeling of frustration, one major bank made this comment:

“We need to see the hockey stick moment, because we have all made a very big investment in Open Banking.”

The opening keynotes focused on the increasing adoption of things such as ‘pay by bank’ in e-commerce, and the growing dominance of digital wallets and real time payments in the payments sector. Important and notable progress, and the sheer volume of people at OBE suggests that the sector continues to gather momentum.

Paul Horlock, CPO of HSBC, told the audience that the most important element in the relationship between a bank and its customers is time, and that banks should help their customers make best use of their time. He stated that making it easier to send and receive money is a critical banking service in this regard.

A highlight of the morning was a panel titled ‘Driving payments modernisation in an Open Banking Era’. Chaired by Kirsty Rutter of Lloyds Banking Group, the straight talking panel included NatWest, Monzo, Clear Bank, Innovate Finance and CFIT and had some hard hitting messages. These included Charlotte Crosswell, Chair of CFIT, stating that Open Banking has failed to deliver on its initial objectives, and there appeared to be unanimous agreement on Kirsty Rutter’s suggestion that having led the charge globally, the UK is now being overtaken by other nations. Andy Sacre of Monzo said that the industry needs to focus on what customers want, and not get caught up in jargon. I think it’s a good point… Open Banking has brought us a wealth of poorly understood acronyms including (but certainly not limited to) A2A, AISP, PISP, VRP, CM9…. Indeed, a google search for ‘open banking acronyms brings up a wide array of jargon busters. But to come back to Andy’s point, these terms mean nothing to consumers.

A hot topic at the event, and one of the most eagerly awaited (and long called for) developments, was the introduction of commercial Variable Recurring Payments (VRPs). With a commercial VRP it will be possible to authorise a bank account with pre-approved parameters, such as the total amount that can be spent per month and a maximum transaction size. This will be a huge benefit tor consumers and businesses in making and receiving payments, because the process will be seamless and once these parameters have been agreed, subsequent transactions can be accepted with one click/tap.

Data (Use and Access) Bill & National Payments Vision

Since the event, there have been two significant developments which have led to considerably more positive sentiments emerging amongst the Open Banking community.

Firstly, we saw the introduction of the Data (Use and Access) Bill to Parliament on 23 October 2024. On the gov.uk website, the announcement included this wording, highlighting the significance to Open Banking:

“The regulations will create the right conditions to support the future of open banking and the growth of new smart data schemes, models which allows consumers and businesses who want to safely share information about them with regulated and authorised third parties, to generate personalised market comparisons and financial advice to cut costs.”

Secondly, and of equal if not greater significance, On 14th November the Government published the National Payments Vision, which as reported in an article on the OBE website, has been warmly received by stakeholders from across the Open Banking ecosystem.

Tony Craddock, Director General of The Payments Association, posted a call to arms for the payments industry on a LinkedIn post, which included stating:

“You will read a detailed review of the contents of the NPV from The Payments Association and our friends in the coming days. But the time for reflection is over. Our community of passionate payments people is armed with entrepreneurial ambition, fuelled by global investment and enabled by extraordinary talent. The lack of direction from HM Treasury is no longer an obstacle to the achievement of great things. We even have clarity about the reform of Pay.UK; about the role of HMT, the Bank of England and the PSR in aligning regulators; about the role that tech and telecoms companies play in tackling APP fraud; about the renewed enthusiasm for Open Banking and CBDCs; and about the fundamental importance of digital identity.”

The potential of Open Finance

Back to OBE, my stint chairing the Open Finance Show (which was sponsored by Salt Edge), kicked off in late morning when Ezechi Britton, CEO of CFIT, gave an opening keynote about the potential of Open Finance. Ez highlighted the benefits that can be achieved such as enhanced access to finance, security and oversight, and improved financial inclusion. CFIT has led some notable initiatives relating to Open Finance, including its latest coalition and the SME Finance Taskforce it recent chaired, which resulted in a paper calling for some far reaching actions relating to Open Finance and Smart Data.

Stephen Winyard, Chief Sales Officer, of SaltEdge gave a benefits-focused keynote on the opportunities of open finance data, including speaking about the opportunities for integration into a wide range of financial and non financial products in loyalty and rewards that can be opened up by open finance. Following this, Olga Gunchenkova, Associate Director of Payments Strategy and Innovations at Flutter International (owners of brands including Paddy Power, Pokerstars, and betfair), spoke about the adoption of Open Banking within gaming, particularly in terms of pay by bank which is now used for approximately 1 in 10 payments into Paddy Power accounts (a figure which is aligned to the overall adoption of this service across the UK).

The afternoon saw a ‘Powerhouse Debate’ which saw a line up including NatWest, Barclays, Lloyds Bank and Salt Edge, expertly chaired by Emma Lindsey, Managing Director of CAF. The panel focused on digital identity and whether it’s possible for the UK to have a truly digital economy without one. It was a fascinating session which covered topics ranging from how digital identity can deliver benefits in terms of efficiency, financial inclusion and economic value, whilst also highlighting areas of concern such as risk of increased fraud, and the big question of why the UK is so behind other nations in the process of adopting an interoperable digital identity programme. One challenge is that there are a high number of people in the UK who can’t prove their identity, which means there is a risk of digital exclusion if we go down a route of digital identity.

Throughout the day there were numerous pitches from Open Finance innovators and it’s always fascinating hearing about their businesses and hearing how they are seeking to help modernise and transform the sector.

There is certainly a growing focus on Open Finance, but in regulatory terms it remains a future development, and one where the industry is waiting to see what the commercial model / incentives will look like. In the meantime, the level of anticipation within the financial sector remains high, and the future vision of enhanced connectivity across financial products and beyond is a powerful one.

Onwards and upwards

Having originally drafted this blog last month, I have updated it a couple of times following the publication of the Data (Use and Access) and Bill National Payments Vision, which provided some tangible positivity. It wasn’t quite a case of this being the Open Banking equivalent of the famous ‘Hello Muddah, Hello Fadduh’ song but it did occur to me that the picture has evolved significantly in a short period of time. Given the positive actions by the Government, It seems Open Banking and Open Finance can look forward to playing increasingly prominent roles in the UK’s growth strategy over the coming months and years.

There are areas that Whitecap will continue to factor in to our work on growth strategies for mid sized businesses across key sectors such as financial services and FinTech, and our clients will undoubtedly also continue to have this at the forefront of their thinking in relation to strategy, innovation and change within their businesses and their markets.