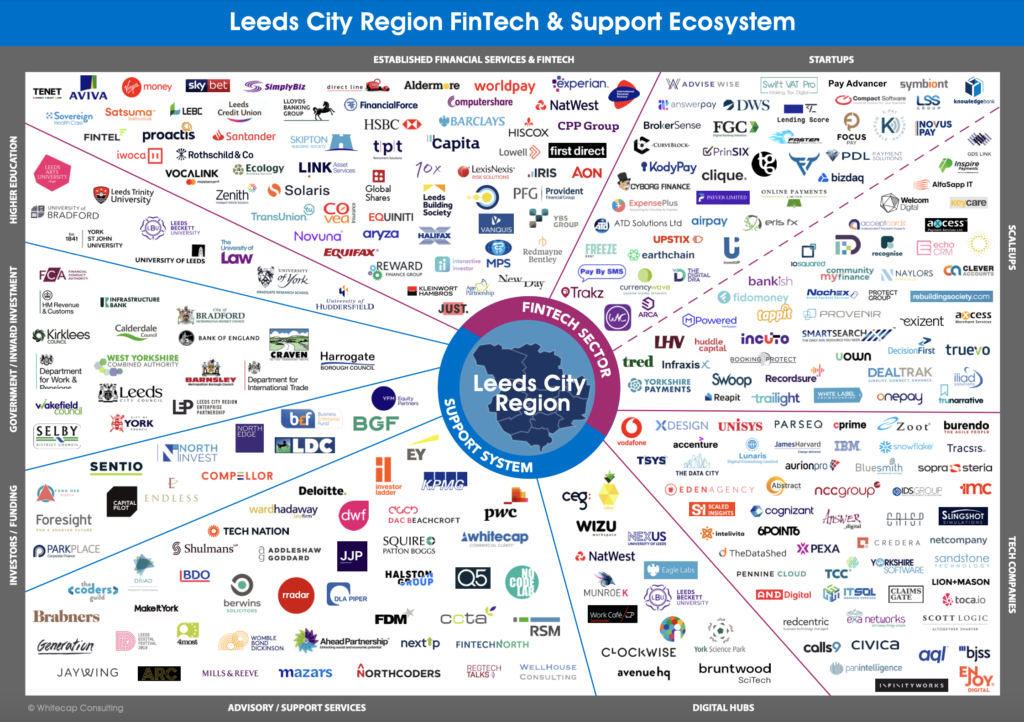

The report is published at a time when the financial sector in the region is thriving, buoyed the decisions of the Financial Conduct Authority, UK Infrastructure Bank and Bank of England to establish bases in Leeds. More than 100 FinTech firms have now been identified in the Leeds City Region, the vast majority of which are startups and scaleups, a segment which has trebled in number over the last 3 years. Core strengths are visible in payments, lending, financial regulation, wealth management, and banking.

The report is published at a time when the financial sector in the region is thriving, buoyed the decisions of the Financial Conduct Authority, UK Infrastructure Bank and Bank of England to establish bases in Leeds. More than 100 FinTech firms have now been identified in the Leeds City Region, the vast majority of which are startups and scaleups, a segment which has trebled in number over the last 3 years. Core strengths are visible in payments, lending, financial regulation, wealth management, and banking.

The region is already home to more than 60 established national and international financial services organisations, all of which are active in FinTech, including numerous banks and lending firms, and 3 of the UK’s largest building societies. Leeds is also the only city outside London to be home to all 3 of the UK’s major credit reference agencies.

Richard Fearon, Chief Executive at Leeds Building Society, says:

“Tech and innovation are integral to providing the modern financial services that the Leeds City Region has become synonymous with. One-in-five of our people at Leeds Building Society hold a digital or tech role and they are fundamental to us delivering for our members. A thriving local FinTech industry also has a major role to play which is why we have been delighted to support this report.”

The new report is the result of a research project which was funded through sponsorship and support from organisations including: Leeds City Council, Leeds Building Society, LexisNexis Risk Solutions, Bruntwood SciTech, Cloud Gateway, Equiniti, University of Leeds, FinTech North and Leeds City Region Enterprise Partnership. It is the third report published by Whitecap on the Leeds City Region; the last was published early in 2020, just before the onset of the Covid pandemic.

The new report is the result of a research project which was funded through sponsorship and support from organisations including: Leeds City Council, Leeds Building Society, LexisNexis Risk Solutions, Bruntwood SciTech, Cloud Gateway, Equiniti, University of Leeds, FinTech North and Leeds City Region Enterprise Partnership. It is the third report published by Whitecap on the Leeds City Region; the last was published early in 2020, just before the onset of the Covid pandemic.

Tom Riordan, Chief Executive, Leeds City Council, says:

“Whitecap Consulting has provided structure and clarity to the FinTech ecosystem in this report, and the in-depth research and analysis both quantifies and qualifies the strength, growth and maturity within the sector. It is great to see double digit growth across all of the key metrics since 2020, and the report recognises the diversity and key strengths across the range of tech sub sectors, from RegTech to LegalTech.”

Whitecap’s analysis shows huge growth of 263% in the number of FinTech startups and scaleups with a presence in the region, which now amount to 87 firms. In total there are 107 FinTech firms, and more than 200 firms identified as operating in the FinTech sector, including financial services and tech firms. The sector has been boosted in recent years by the decisions of organisations such as LHV UK, Iwoca, Recognise Bank, Global Shares, and PEXA to establish bases in the region. New startups over the last 2 years include Answer Pay, the UK’s first certified provider of Request to Pay services, and Tred, which lays claim to be the only FinTech in Europe to be both B-Corp pending and a member of 1% For The Planet. Whitecap’s data analysis was conducted using a variety of publicly available and subscription-based third party databases and platforms, including its primary data partner The Data City.

Steve Elliot, Managing Director, LexisNexis Risk Solutions (UK & Ireland), says:

“LexisNexis Risk Solutions is proud to have supported this report and to play an active role in the economic prosperity of the Leeds City Region, which as this report shows, has been experiencing strong growth. We acquired Leeds-born tech start-up, TruNarrative in August 2021, and we are proud to have a home in Leeds and to be creating a range of exciting job opportunities as we continue to expand the team supporting the LexisNexis RiskNarrative orchestration platform.”

Deb Hetherington, Head of Innovation Services at Bruntwood SciTech, said:

“FinTech has long been a high profile feature of the Leeds economy and bridges the vibrant tech and financial services sectors in the region. The strength of FinTech in Leeds that is evident in this report is also reflected in the organisations based at our Platform tech and digital workspace, where FinTech is prominent along with other fast growing digitally-led sectors such as LegalTech and HealthTech. We look forward to playing our role in the sector’s continued success over the coming months and years.”

In 2021 a strategic review of the UK FinTech sector was published (the Kalifa Review), which highlighted the growth of FinTech across the UK. The Kalifa Review identified 10 key FinTech clusters in the UK, with the Leeds-Manchester cluster being cited as one of three ‘established’ clusters outside London. The Review also recommended the creation of the Centre for Financial Innovation and Technology (CFIT), which will be launched later this month.

Chris Sier, HM Treasury FinTech Envoy for England, Chair of FinTech North, Visiting Professor at University of Leeds, & Chair of ClearGlass, says:

“Over recent years we’ve seen the accelerated development of FinTech across the regions of the UK, with increased national focus coming via initiatives such as the Kalifa Review, FinTech National Network, and now the newly created Centre for Finance, Innovation and Technology (CFIT). Leeds has played a prominent role throughout this national evolution, and continues to thrive due to the strength of its Financial, Tech, and FinTech sectors, which have always been strongly supported by the public sector and the region’s many universities.”

Charlotte Crosswell OBE, Chair, Centre for Finance, Innovation & Technology (CFIT), adds:

“The growth of the FinTech sector in Leeds is very impressive, and I look forward to working with the financial services, FinTech and technology sectors in the region and across the UK to drive international FinTech growth, attract talent into the fintech sector, and ensure better outcomes for consumers and SMEs. It is important we continue to enhance the links between industry, academia, government and regulators to support this exciting sector, and ensure that its impact is felt up and down the country.”

A launch event for the new report took place at a FinTech North event at Leeds Building Society’s head office on the morning of 14th February.

Download Leeds City Region FinTech Report 2023