Published by Whitecap Consulting, a strategy consultancy, and supported by Intuit, the global financial technology platform and owner of QuickBooks, the report analyses the potential future impact of smart data via the development of Open Finance, a term which is widely accepted as referring to the expansion beyond Open Banking into a wider range of financial products and services.

Published by Whitecap Consulting, a strategy consultancy, and supported by Intuit, the global financial technology platform and owner of QuickBooks, the report analyses the potential future impact of smart data via the development of Open Finance, a term which is widely accepted as referring to the expansion beyond Open Banking into a wider range of financial products and services.

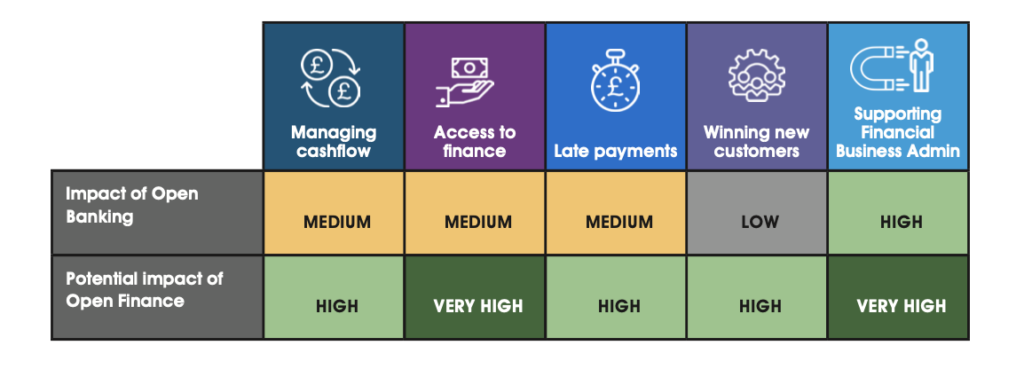

The research conducted for the report included interviews with 35 industry experts and small businesses, and concludes that Open Finance could deliver considerably enhanced benefits to small businesses than they currently experience from Open Banking. For each of the five small business challenges, the new report analyses depth of the issue for small businesses, the impact Open Banking has had to date, and the potential future impact of Open Finance. Additionally, the report identifies the datasets that are likely to be required within the scope of Open Finance and provides example use cases.

Julian Wells, Director and Financial Services & FinTech Lead at Whitecap Consulting, said:

“Open Finance has been a hotly debated topic in the financial services sector for some time now, with considerable focus placed on the potential implications for banks, financial services providers, FinTech firms, and policy makers. A group that has not been prominently represented in these debates is small businesses, but 99.2% of the UK’s companies are small businesses with fewer than 50 employees, employing 12.9 million people. Small businesses have undoubtedly benefited from Open Banking and other data related technology developments, but we have found that Open Finance represents a bigger and broader opportunity to benefit these firms.“

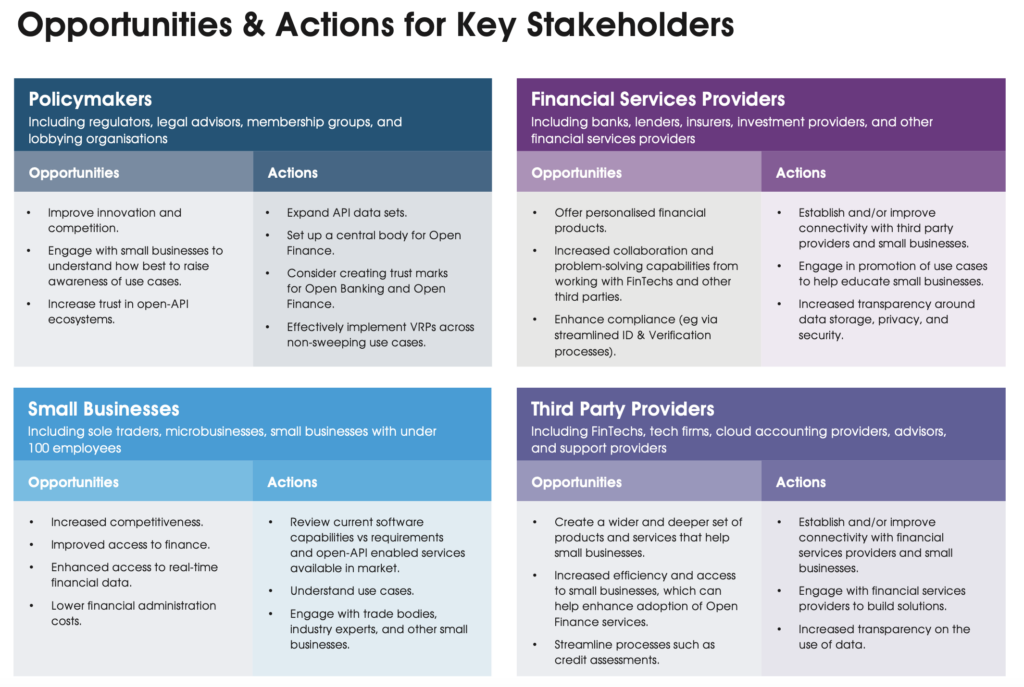

The report concludes that in order to unlock the opportunities offered by Open Finance, there are three key areas of consideration for policymakers:

- Support of small businesses should be an area of specific focus in the development of Open Finance framework, and innovation and competition can be improved by participation, data-sharing, the development of a roadmap, and an educational campaign.

- A number of issues will need to be addressed to unlock the opportunities that Open Finance can present, including the fuller adoption of Open Banking, development of a regulatory framework, clarity on data ownership and sharing, and the design of an effective commercial model.

- Developing an effective Open Finance framework could help small businesses address the key challenges they face, which could deliver significant benefits in terms of competitiveness and efficiency.

Jolawn Victor, Vice President and UK Country Manager, Intuit, said:

‘Today’s business environment is without precedent. Inflation, the cost-of-living crisis and fierce competition to attract and retain talent are just some of the factors creating a uniquely complex ecosystem for small businesses. With over 72% of small business owners struggling to accurately forecast their annual earnings and 50% having difficulty accessing financing, Open Finance offers many reasons to be optimistic. As financial technologies and solutions develop, data holds the key to small business prosperity, offering these businesses the opportunity to unlock growth as well as access alternative and often more advantageous investment, borrowing and lending opportunities. ”

The report includes a foreword from the recently launched Centre for Finance, Innovation and Technology (CFIT), and will be presented and discussed at a launch event at the House of Lords on 16th May. The event will be attended by politicians, senior industry leaders, subject matter experts, and representatives from small businesses.

Kevin Hollinrake MP, Small Business Minister, who is speaking at the launch event, said:

“Smart Data presents a massive opportunity for UK small and medium-sized businesses to unlock exponential growth.

A new regulatory framework for open banking is being developed by HM Treasury, intending to use the Smart Data Clauses in the Data Protection and Digital Information Bill.

With Smart Data, we have the ability to extend the benefits of data sharing initiatives like Open Banking into new sectors – we welcome stakeholder input to ensure that we can empower consumers and small businesses with innovative and bespoke services, harnessing the expertise of the Fintech sector in the UK. Smart Data schemes will turbo charge competition across the economy leading to greater choice for consumers and small businesses.”

Download the report